Skift Take

When it comes to out-performing the online travel industry in terms of a post-Covid booking recovery, eDreams Odigeo can claim a top prize. It is plowing revenue back into discounts to make its subscriptions a no-brainer.

Dennis' Online Travel Briefing

Editor’s Note: Every Wednesday, Executive Editor and online travel rockstar Dennis Schaal will bring readers exclusive reporting and insight into the business of online travel and digital booking, and how this sector has an impact across the travel industry.

Online Travel This Week

One of the most frustrating things about loyalty programs for infrequent business travelers or vacationers is that the opportunity to cash in those accrued miles or points for free flights or hotel stays often seems as rare as a double rainbow. Enter the Spanish flight-booking online travel agency, eDreams Odigeo.

Edreams Odigeo’s growing Prime subscription program offers discounts of varying sizes on every flight booking. The company announced Wednesday that Prime now counts 3.5 million subscribers, after notching its largest ever quarterly growth in April, May and June, namely 560,000 paying members. The annual fee to join is around $60.

In its fiscal 2023 first quarter, which ended June 30, the company saw its net losses narrow to 13.9 million euros (-$14.13 million), from a loss of 23.9 million euros ($-24.3 million) a year earlier, and its bookings grew to 4.4 million. That booking figure was 50 percent higher than the same quarter in calendar year 2019.

“July and August, we have continued to experience strong growth, with July and August bookings growing 38 percent and 55 percent above pre-Covid-19, respectively,” CEO Dana Dunne told analysts Wednesday in a review of the company’s quarterly results. “All of this has been realized under the Ukraine war, Covid, high inflationary pressure, flight disruptions, et cetera.”

Although admittedly very different companies, eDreams Odigeo’s mark of bookings 50 percent higher in the June quarter than during the same period in calendar year 2019, compares favorably with another company out-performing the rest of the travel industry, namely Airbnb. In the June quarter, Airbnb reported that its nights and experiences booked increased 24 percent compared with 2019 numbers.

On the profit question, eDreams Odigeo forecast that in fiscal year 2025 it would achieve a 22 percent cash EBITDA (earnings before taxes, interest, depreciation and amortization) margin.

Meanwhile, the company “intends to give back the vast majority of additional revenue and profit back to Prime members in the form of additional discount,” said eDreams Chief Financial Officer David Elizaga Corrales.

About the company’s intent to get repeat customers and to entice them to making flight bookings with eDreams Odigeo habitual, he added: “We want our prime numbers to have our wonderful value proposition and to repeat every date with us.”

Both eDreams Odigeo and Booking Holdings, are employing discounting tactics to win market share. That is not an uncommon practice in online travel, but Booking Holdings, for one, is leaning into the practice.

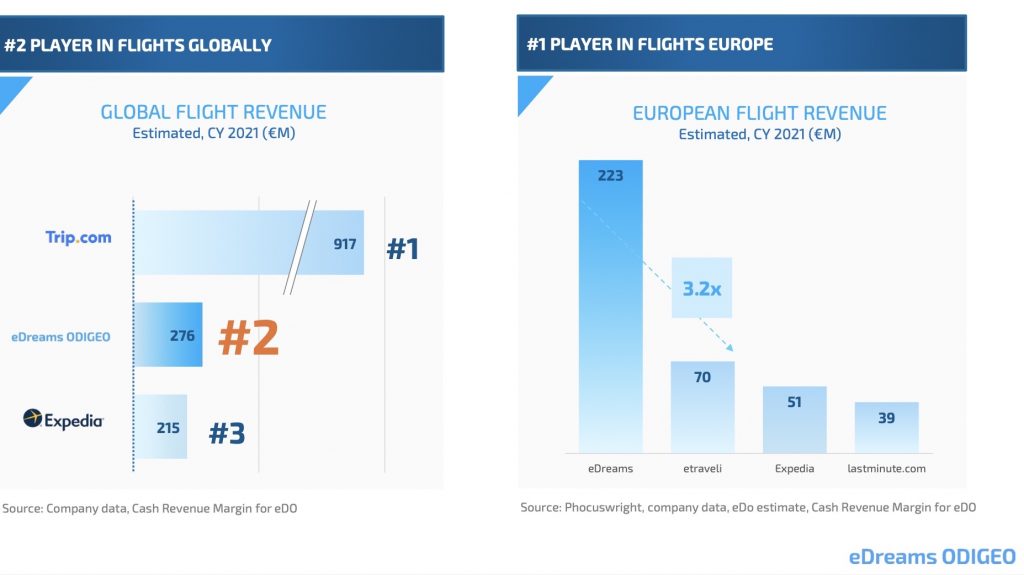

EDreams Odigeo stated that it is the largest flight booker in Europe by revenue, and second in the world behind China’s Trip.com Group.

In the chart, eDreams Odigeo stated it was 3.2 times larger than its closest European competitor, eTraveli Group, which Booking Holdings is in the process of acquiring, pending final regulatory approvals.

Asked by an analyst whether eDreams Odigeo was feeling pricing pressure on flights from Booking.com, Dunne said: “The simple answer is no. To be clear, Booking.com has been offering flights for the past four, five years. No, we don’t see price pressure.”

Edreams Odigeo added 130 employees to its roster in the June quarter, and most have been assigned to relatively new initiatives, including expanding into the United States and building out its hotel offer. Officials said these would basically be multiyear efforts.

In Brief

FareHarbor Is Searching for a New CEO

FareHarbor acting CEO Ted Clements will step down in September, and Booking Holdings’ tours and activities unit is searching for a replacement, Skift has learned. The change was announced internally at Booking. Skift

No, Google Is Not on Track to Put Airbnb Out of Business

Direct bookings of short-term rentals can be very attractive to hosts and guests if they can thereby eliminate paying substantial fees to third parties, but it’s not as simple as a host tossing a link into a Google business listing, as one semi-viral tweet suggested. We explain why Google isn’t on the cusp of putting Airbnb out of business. Duh. Skift

Hopper’s Short-Term Rental Business is Evolve-ing

Hopper struck direct deals with property managers Evolve and Vtrips to bring their homes into the Hopper app. The agreements are geared to give Hopper more control over inventory types and to enhance relevant offers to customers. Skift

Ask Skift Is the AI Chatbot for the Travel Industry

Go deeper into the business of travel with Skift’s new AI chatbot.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, booking.com, Dennis' Online Travel Briefing, discounts, earnings, edreams, edreams Odigeo, etraveli, evolve, fareharbor, future of lodging, online travel newsletter, Skift Pro Columns, subscriptions, trip.com group, vtrips