Summer travel season is in full swing and we can already hear the complaints: “It’s outrageous what they’re charging for a hotel room these days!” The narrative goes that greedy hoteliers are taking advantage of pent-up vacation demand to gouge desperate travelers. But this is a myth and far from the reality of the hotel business today.

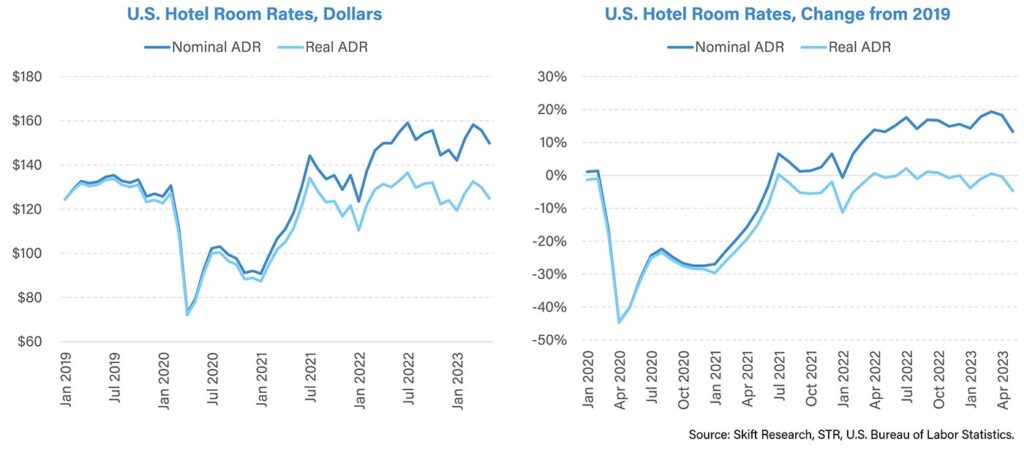

It’s true, the average hotel room in America went for $150 a night in May, a 13 percent hike from 2019. But that gain doesn’t account for inflation. The recent government data on inflation is a good reminder that the price of everything, not just hotels, rose during the pandemic. To debunk the myth of the greedy hotelier, we need to place the price of a room in this broader context.

If we adjust for inflation, today’s $150 a night is equivalent to $125 in 2019 terms. That’s actually a 4% decline from May 2019. Adjusting hotel price data for inflation reveals that U.S. hotels have regained pre-pandemic rates in real terms but little more. In fact, far from price gouging, hotels have taken almost no price increase in real terms.

Hotel operators have experienced rising costs to operate their business. Everything from fuel and heating, to wages, to food costs, to laundry supplies are more expensive today. The inflation data suggests that most hoteliers are increasing their prices to keep pace with their rising costs. If they aren’t making more profit, that’s not price gouging.

We can benchmark the various categories that make up inflation relative to the broadest gauge of prices. This tells us where prices are rising faster than the overall rate of inflation. The culprits, it turns out, are transportation (with a large assist from fuel prices), food costs, and housing costs.

In contrast, the two major travel expenditure categories, hotels and airlines, have raised prices at or below the overall pace of inflation. This means that in real terms, the price of these travel services are flat or down versus 2019.

And while we’re at it, spare a thought for those other price gouging villains, the airlines. In real, inflation adjusted, terms that industry has been on a steady pricing power decline since 2014.

Skift has been covering inflation and it’s impact on the travel industry since the pandemic. To dive deeper into the subject, why not start by asking Ask Skift, a generative AI chatbot ‘trained’ on our news stories and research?

Inflation is also increasing operating costs for travel businesses. Marriott Vacations Worldwide Corporation mentioned in their 10-K (February 2023) that inflation can increase costs such as unsold inventory, development, labor, service contracts, insurance, technology, and interest rates. Similarly, Xenia Hotels & Resorts, Inc. (March 2023) and Summit Hotel Properties, Inc. (February 2023) stated that inflation could affect their expenses, including wages, benefits, food, taxes, property and casualty insurance, borrowing costs, and utilities.

In a high inflationary environment, travel businesses may struggle to raise their prices proportionally, which could reduce their operating margins and negatively impact their financial results. Furthermore, inflation may reduce the demand for travel, levels of spending in transient or group business and leisure segments, and consumer confidence (Xenia Hotels & Resorts, Inc., March 2023).

Travel businesses are also dealing with the challenge of increased renovation costs due to inflation. Host Hotels & Resorts, Inc. (February 2023) mentioned that the current inflationary environment can increase the costs of hotel renovations and decrease the purchasing power of their cash resources.

Lastly, inflation and currency depreciation can impact corporate travel budgets and pose headwinds to travel recovery. BCD Travel warned that high inflation and depreciation of the Turkish Lira were affecting corporate travel budgets in Turkey, leading to a challenging travel environment (January 2023).

In summary, inflation is impacting travel businesses by reducing consumer demand, increasing operating costs, affecting pricing strategies, and posing challenges to corporate travel budgets. These factors can have adverse effects on the financial performance and growth of travel businesses.

Subscribe to Skift Pro to get unlimited access to stories like these

{{monthly_count}} of {{monthly_limit}} Free Stories Read

Subscribe NowAlready a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Your story count resets on {{monthly_reset}}

Already a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Already a member? Sign in here