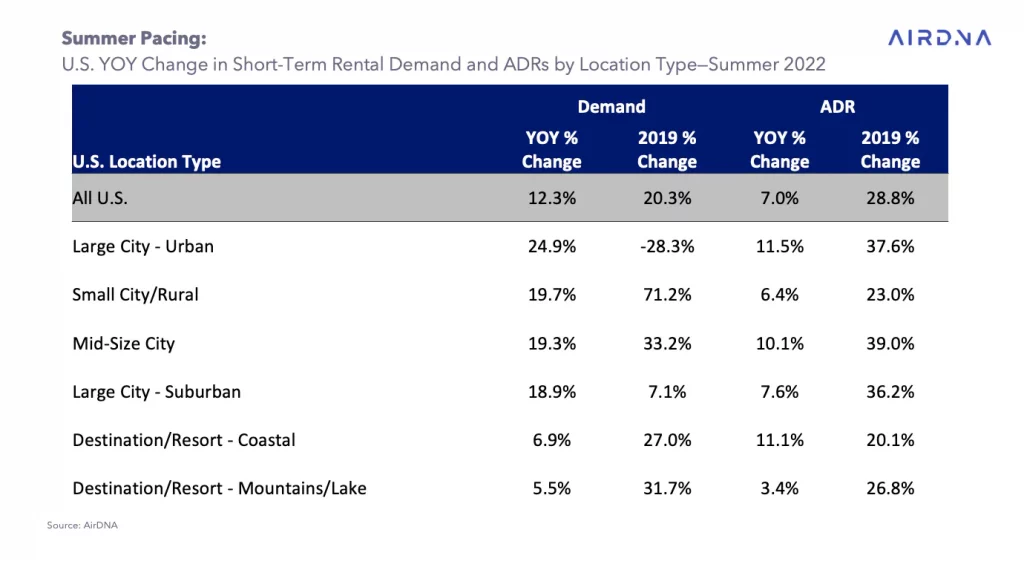

Despite the fears of recession and soaring fuel prices that have retreated somewhat in recent weeks, average daily rates for short-term rentals in the U.S. this summer jumped 7 percent year over year — and that’s nearly 30 percent higher than the summer of pre-pandemic 2019.

Those conclusions were part of an update to AirDNA’s mid-year 2022 outlook, which said U.S. average daily rate growth is highest in urban and coastal areas. (See chart below).

“As we look to summer 2022 (June-August), more STR nights have been booked than any other summer in history, as of the end of June,” the report said. “The previous record was set just last year, and the U.S. is currently seeing 12.3% more booked nights than at the same point in time in 2021.”

Short-term rental demand in big cities this summer, though, is still 28.3 percent lower than in the summer of 2019, AirDNA found.

In addition, AirDNA forecast that the U.S. supply of short-term rentals would jump 21 percent year-over-year in 2022 as both Airbnb and Vrbo increased their listings.

“With supply outpacing demand growth as expected, our outlook for occupancy is largely unchanged,” AirDNA said. “Our revised forecast now calls for U.S. occupancy to average 58.2% for the year, slightly lower than our 59.8% forecast in October.”

AirDNA’s occupancy numbers seems to be more bullish than those of Key Data Dashboard. The latter’s occupancy stats may skew more heavily toward vacation rentals specifically.

Occupancy rates in the U.S. in the third quarter (July, August and September) are currently at 39 percent, down from 45 percent during the same period in a standout 2021, according to Melanie Brown, director of analytics at Key Data Dashboard, which tracks vacation rental data.

Tags: airbnb, airdna, occupancy, rates, vacation rentals, vrbo