Skift Take

China's Trip.com Group is entering the content and advertising spheres to address longstanding weaknesses in its transaction business. It joins a plethora of travel businesses that are remaking themselves, whether they are launching financial services or subscription offerings, during the pandemic.

Many travel businesses, whether it is Trip.com Group in China, Traveloka in Indonesia or Despegar in Argentina, are refashioning themselves during the pandemic.

For China’s Trip.com, formerly known globally as Ctrip, it is trying to diversify away from its over-reliance on transactions, particularly because the hotel discounting frenzy in China, and its dependence on airline ticket sales, lead to sub-par commission levels.

In its fourth quarter and full-year 2020 earnings call earlier this month, Trip.com officials detailed how they are getting into the content business to get a line into airline, hotel and destinations’ advertising budgets.

“We traditionally only made most of our money from commission,” co-founder and Executive Chairman Jianzhang “James” Liang told analysts during the earnings presentation. “So it’s really coming out of the sales budgets of airlines and destinations and hotels. Of course, as we know, they also have a marketing budget and branding budget, probably just as large and the same order magnitude, and it’s just as large as the sales budget. So this is the area that we hope to, through our marketing and platform and our content capability, be able to tap into in the near future.”

He said focusing on content creation and travel inspiration will attract new customers for Trip.com Group, entice them to engage more frequently, and spend more time on the brands’ apps, which are seeing increased spending in domestic packages, for example.

Getting Into Content Creation and Advertising

The move into content creation and the goal of creating advertising revenue comes after Trip.com Group entered into a joint venture with Massachusetts-headquartered Tripadvisor in late 2019 to share content on their respective platforms. Trip.com Group CEO Jie “Jane” Sun now has a Tripadvisor board position.

Tripadvisor, of course, has long brought in the majority of its revenue from advertising/media, as opposed to transactions. Advertising is a relatively high-margin business compared with transactions.

We are not alleging that Tripadvisor is somehow directing or teaching Trip.com Group the content business. This isn’t a situation of an all-knowing fair-haired Western business teaching a Chinese enterprise, which was founded in 1999 and even prior to Tripadvisor, a thing or two about the travel business.

There are plenty of logical reasons for Trip.com Group to get into the advertising business, and ways to learn about it. There may be many homegrown advertising models in China. Expedia Group, too, has long had an active media solutions business.

But it wouldn’t be surprising for Trip.com Group, given its new strategic partnership, to compare notes with Tripadvisor on its longstanding experience in the advertising arena.

Addressing Weaknesses

Here are some of the problems that China’s largest travel agency, which has its online platform but also operates thousands of stores, particularly in lower-tier cities, is addressing with its move into the advertising business:

Skift’s Deep Dive Into Trip.com Group 2020 cited the fact that In May 2017, Trip.com Group disclosed that its net take rate on hotels because of couponing, or discounting, was relatively small at 8-10 percent. The company also has a dependence on flights, which is a great source for new customers, but provides low commissions.

Fast-forward to 2020, and you can see from the chart below that although Trip.com Group greatly outpaced Expedia Group and Booking Holdings in gross bookings, or the total value of travel goods sold, it lagged in revenue despite the relatively robust nature of China’s Covid travel recovery compared with the United States and Europe.

Trip.com Group Had the Largest Gross Bookings Among Its Peers

| Company | Revenue | Net Income/Loss | Gross Bookings |

|---|---|---|---|

| Trip.com Group | $2.8 billion | $497 million | $61 billion |

| Expedia Group | $5.2 billion | $2.7 billion | $36.8 billion |

| Booking Holdings | $6.8 billion | $59 million | $35.4 billion |

In fact, Trip.com Group attracted $61 billion in gross bookings in 2020 compared with $36.8 billion at Expedia Group and $35.4 billion at Booking Holdings.

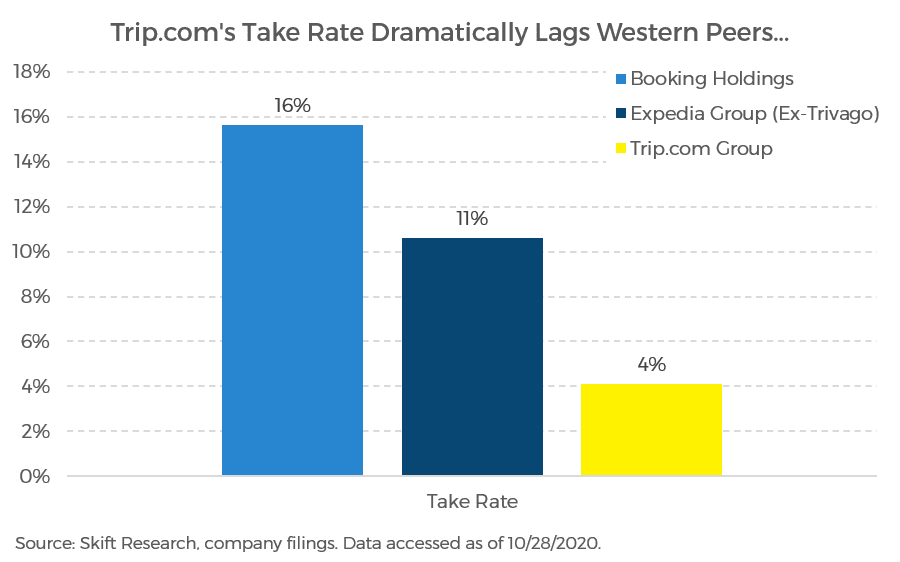

Skift Research’s deep dive into Trip.com Group, which used data as of October 28, 2020, found that Booking Holdings’ take rate, or commission levels, were the highest at 16 percent, Expedia Group generated 11 percent, and Trip.com Group lagged considerably at 4 percent. Hotel commission levels in China are generally much lower than they are in North America or Europe.

So it is likely a smart move for Trip.com Group to address some of these take rate and margin weaknesses by entering the content and advertising business.

Sun explained during the earnings call that many Trip.com users already write reviews and travel journals on its platform, arguing that its “strong product and transaction capability allows to make content-to-transaction conversion easy and frictionless.”

Said Sun: “For example, our livestream channels delivered the highest conversion rate in travel industry last year. So for these reasons, we are confident to see that we will be one of the go-to platforms for users that seek both travel inspirations and values for care in the short-haul and long-haul travel demand.”

Ask Skift Is the AI Chatbot for the Travel Industry

Go deeper into the business of travel with Skift’s new AI chatbot.

Have a confidential tip for Skift? Get in touch

Tags: advertising, airlines, booking, china, commissions, ctrip, expedia, hotels, trip.com, tripadvisor

Photo credit: Chinese travelers in the upscale shopping district of Ginzo in Tokyo, Japan on July 18, 2018. Trip.com Group wants to generate advertising revenue through content creation. Toshihiro Gamo / Flickr.com