Skift Take

Hotels are hiring companies to clamp down on online travel sites displaying cheap rates against their wishes. One of those startups, Fornova, has just bought smaller rival HotelsBI to broaden its rate-detection service. The deal is partly justified by the increasing tech spending on a cat-and-mouse-game between hoteliers and providers of rogue rates.

The typical consumer likes to visit a price-comparison travel site and see a wide array of hotel rates from multiple sources for a stay on the same night and at the same property. However, the typical hotel dislikes how it doesn’t always know what rate its rooms are selling for across the internet.

Hotel worries about “rate integrity” are as old as the internet. But lately, hotels appear to be paying more attention. Some have begun to administer penalties to online travel agencies and wholesalers they believe aren’t being above board.

To sleuth who’s to blame, hotels are increasingly using new tech tools. Fornova is one startup, based in Yokne’am Illit, Israel, that made its name by monitoring and benchmarking rates online and has a sideline in helping fight rogue rates.

“For example, we help Hyatt see what we call a ‘distribution health’ score for each of their properties which lets them benchmark performance and pinpoint which ones are doing better or worse,” said Dori Stein, CEO of Fornova.

Another leading rate-tracking startup is OTA Insight, a London-based company that also works with hotel companies of all sizes. RateGain, a private equity-backed travel technology company based in Noida, India, is a third.

Fornova Acquires HotelsBI

On Monday Fornova confirmed to Skift that it has acquired HotelsBI, a smaller competitor that offered business intelligence (BI) tools to hotels. The companies didn’t reveal deal terms.

The acquisition highlights the growing supply of tools for hoteliers to maintain rate integrity.

HotelsBI plugs into hotel operational systems that are often separated, bringing together relevant data in a visual dashboard that provides revenue managers with a snapshot for grasping their market position by several metrics.

Fornova CEO Dori Stein said the combination would round out Fornova’s platform and bring it about 300 clients in Northern and Central Europe.

HotelsBI had not publicized any external funding.

A Rising Interest in Rogue Rates

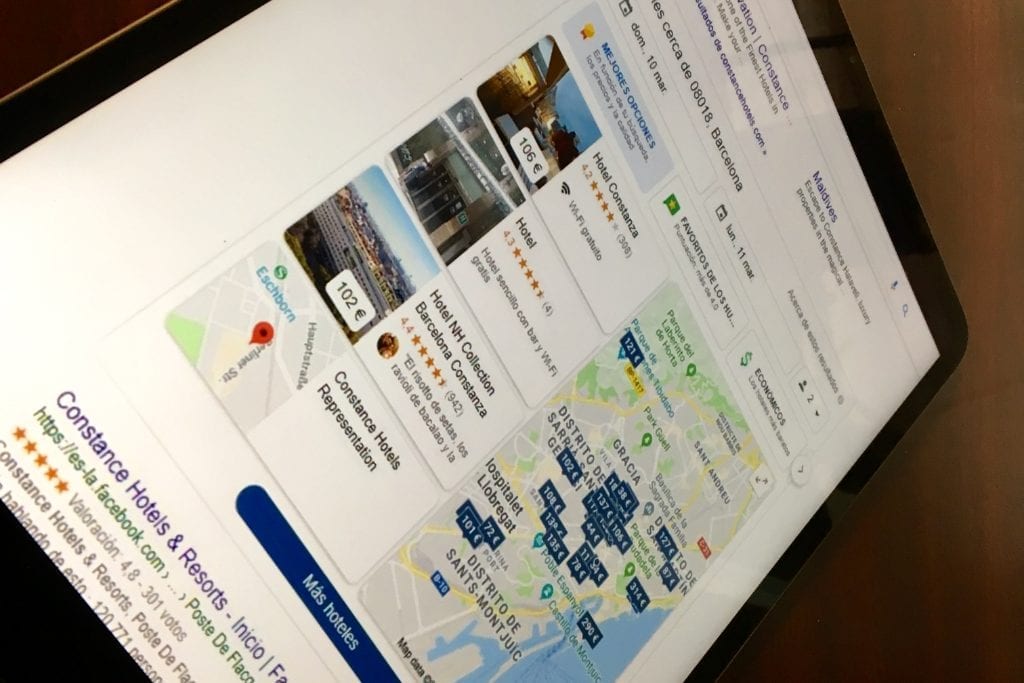

A few factors are driving hotel concern about rogue rates. One is that Google’s hotel metasearch is increasingly pointing consumers to the rates of smaller online travel agencies they haven’t heard advertised on TV.

“The rising traffic from Google Hotel search is giving oxygen to smaller online travel agencies that sometimes use non-contracted rates,” said Sean Fitzpatrick, CEO of OTA Insight. “Given all of their recent “book direct” marketing campaigns, they feel they have more to lose when consumers patronize smaller online travel agencies instead.”

The problem seems to particularly plague independent and regional or local chains in North America and Europe. Cheap rates displayed on non-contracted online travel agencies undercut the brand direct rates of those smaller players between 41 and 47 percent of the time, according to a study last year. To be sure, vendor surveys are suspect because vendors have an interest in exaggerating the size of the problem. But the data suggests that rogue rates aren’t isolated incidents.

New Ways to Clamp Down on Rogue Rates

Where do rogue rates come from? A classic example is that a hotel might offer wholesale rates to an ethnic travel agency, expecting the agency to sell them offline. However, the agency may then cut a deal with an online firm to quietly forward some of the rates along.

Similarly, hotels may also set aside some rates intended for discounted packages or tours that wholesalers break apart and forward along. The industry jargon for these activities is “wholesale leakage.”

In response, several vendors have popped up to point out to hotel companies which online sites are offering the so-called rogue rates. The companies trawl the internet to collect all of the prices displayed on travel websites worldwide. The vendors distill the data down into a snapshot that hotel’s revenue managers can use to pinpoint problems.

In the past year, Fornova has added mystery shopper services. It has hired teams in India and Ukraine to book and then cancel test reservations. The manual process of making reservations often turns up digital clues to the name of the naughty wholesaler.

OTA Insight added mystery shopper services about a year ago, too, Fitzpatrick said. It also provides hotels with screenshots of how rates appeared on sites that revenue managers could use as documentary evidence to start conversations with the agencies.

Hoteliers that see a pattern of rate undercutting by a particular online travel agency can flag their front desks to collect the reservation details from guests for these bookings because the receipts often reveal the naughty wholesaler.

Up until now Fornova and OTA Insight, which both work with many of the world’s largest hotel groups, have focused on rates displayed on browser-based websites, but many mobile apps offer special rates, too. The companies say they will add mobile rate scraping soon. RateGain, which works with International Hotels Group, Preferred, Kempinski, Mövenpick, Accor, and Okura Nikko properties as clients, said it already offers some mobile rate scraping.

On Thursday, OTA Insight announced a new tool that lets hotels track a disparity between the rates shown on a hotel’s booking engine and a third-party channel for specific geographic markets. For example, hotels sometimes display on their direct sites prices that change according to the country-level information in a user’s internet protocol address. Hoteliers can use the tool to help focus on rate problems in specific countries.

An Unlikely Alliance

The world’s largest online travel agencies, Expedia Group and Booking Holdings, also use some of the tools from Fornova, OTA Insight, and RateGain. That matters for two reasons. One, they directly contract with hotels for the rates they display and so they don’t like it when they lose business to smaller online travel agencies that are undercutting them on price.

Two, the online travel conglomerates have more concentrated money and power that present a potential alliance for hotels when it comes to cracking down on rogue rates. It will take a partnership, not just tech from startups, to achieve significant gains on the problem.

Ask Skift Is the AI Chatbot for the Travel Industry

Go deeper into the business of travel with Skift’s new AI chatbot.

Have a confidential tip for Skift? Get in touch

Tags: hotels, ota insight, RateGain, rates, revenue management

Photo credit: Shown here is a person checking in at Park Hyatt Guangzhou. Sites like Google are directing consumers to online travel agencies that sometimes undercut hotels on rates that are out of contract. Hotel chains like Hyatt are hiring startups to help them track down these rogue rates. Fornova, one of those startups, has acquired another hotel tech vendor, HotelsBI, to help in the effort. Skift