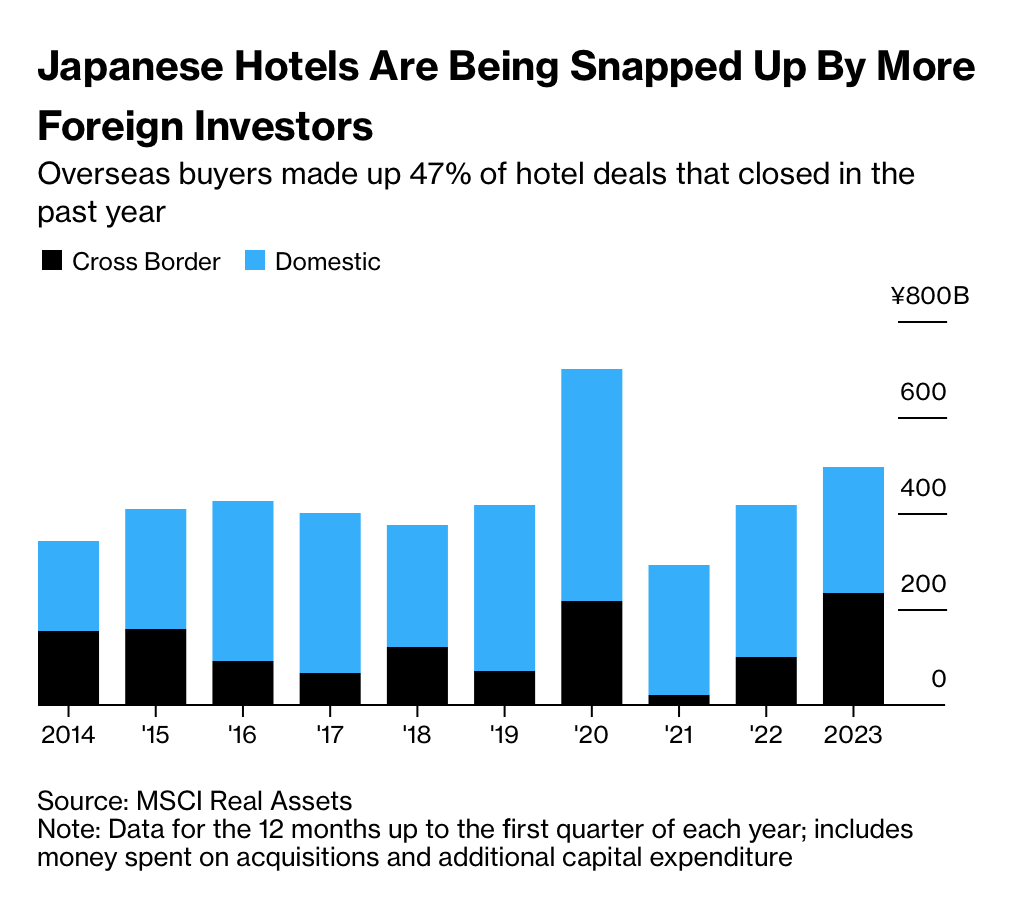

Overseas buyers have made up nearly half of the recent investment in Japanese hotels because of the yen’s relative weakness to other currencies, Japan’s lower interest rates compared to rates in many other major countries, and a rebound in international tourism.

Bloomberg News reported the following striking statement:

“Overseas buyers were responsible for 47% of the 494.3 billion yen ($3.7 billion) invested in hotel deals that closed in the past 12 months — the highest proportion since 2014, according to data at the end of March from research firm MSCI Real Assets.”

Savills recently issued a report predicting low upcoming hotel supply, which will help hotels sustain pricing power. On the demand side, the country is making a concerted effort to reach record levels of inbound tourism, perhaps with a 60 million a year target for 2025.