Scandic Hotels Group has posted its third-quarter results today, with a $49.9 million net profit (559 Swedish krona) and a level of indebtedness that continues to shrink.

“We have delivered another record-breaking quarter and Scandic is standing stronger than ever. Scandic is continuing to make progress in increasing growth and has gradually become a more efficient and profitable company,” said president and CEO Jens Mathiesen.

Scandic operates 55,969 rooms across 269 hotels in the Nordics and wider Europe. The vast majority of its hotels are through long-term lease agreements with other operators, though, as Mathiesen states, an increasing chunk of the network is becoming Scandic’s own brands.

In September, Scandic opened its first Scandic Go with 124 rooms in Stockholm, it also signed two hotels under its Signature Collection that same month.

“We are now focused on growing our hotel portfolio with a stronger organization and intensified cooperation with property owners. For the fourth quarter, we expect occupancy at par with the same period last year at a higher average price per room,” added Mathiesen.

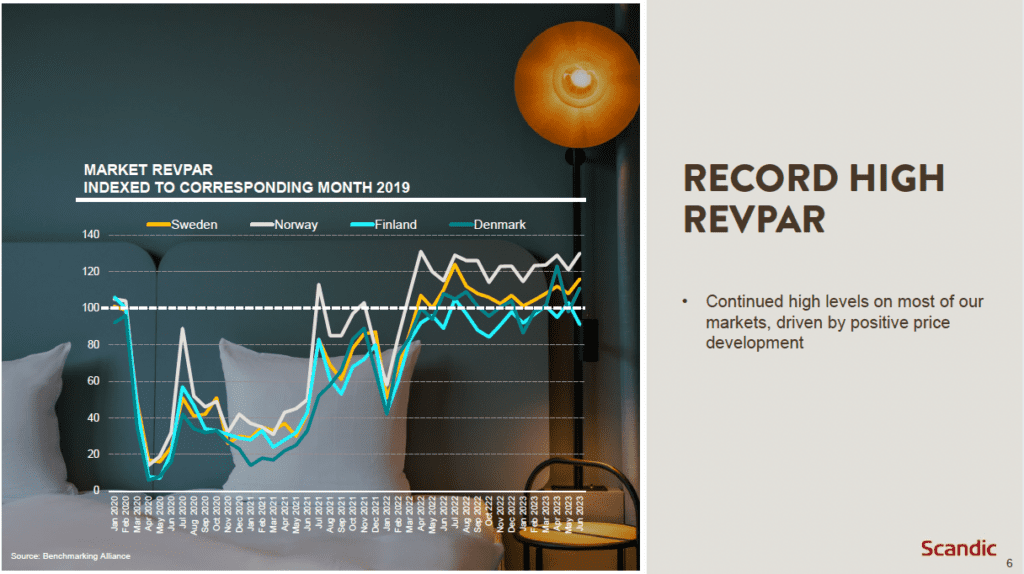

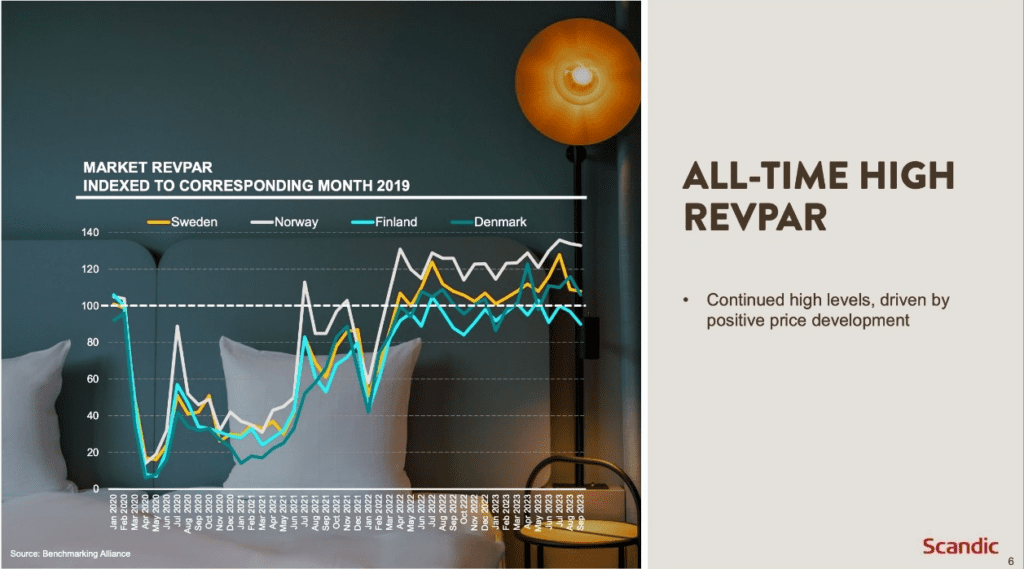

Looking at hotel-specific metrics, the quarter saw some of the highest revenue per available room (RevPAR) and average daily rate (ADR) levels on record for Scandic. RevPAR was up 6.5% compared to last quarter at $83.4 (933 Swedish krona) while ADR was up 5.7% to $117.4 (1,313 Swedish krona).

As of September this year, Scandic’s debt stood at $173.9 million (1.9 billion Swedish krona).

Becoming A Better Company

Mathiesen said in the earnings call that the company has remained focused on efficiency and costs post-pandemic, owing this approach to the group’s strong quarter.

He said: “There’s been a lot of prioritizations of our resources. We are on top of the market when it comes to gaining and taking advantage of opportunities [such as] OTAs and online sales. We are focused on being agile and speedy in our commercial activities.”

“We want to have the best version of everything thing we do. We’re always looking for opportunities to become stronger.”

As for next year, the CEO was hesitant to make any big promises, but said his group would benefit from the strong macro environment of global hospitality. He said: “Right now, globally, the hospitality market is doing extremely well. We’re keeping up a high momentum. There’s a willingness to prioritize traveling and events. It’s holding up. When we look into next year, that’s what we expect. We are well prepared.”