“Airbnb is closing its domestic business in China, according to two sources familiar with the matter,” reported CNBC’s Deirdre Bosa on Monday. According to the report, the pullout from China would shut both Airbnb’s travel lodging rentals and its tours and activities offerings.

China has become the first geographic market for short-term rentals that Airbnb has lost to rivals. Its biggest rival in domestic mainland China has been Tujia.

Airbnb may regret giving up the fight. Consider what happened to Uber after selling its local business to Didi Chuxing, a homegrown rival. Didi is now expanding and looking to compete with Uber throughout the Asia Pacific region once the pandemic eases.

Airbnb could face a similar problem with Tujia. In January 2017, Airbnb came close to merging its China business with Tujia but then walked away from the deal. Tujia is backed by online travel giant Trip.com Group and has raised more than $755 million in funding. It could grow to become a global challenger.

Struggling Sales After Six Years

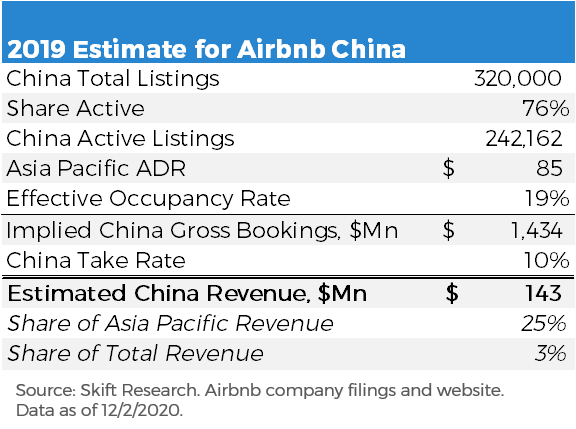

Airbnb’s internal China business was small. Here is what we published in the Skift Research report on Airbnb when the company went public:

“In 2019 Asia Pacific represented 13% of Airbnb’s bookings and 12% of its revenue. So where does the much-vaunted China business fit into this? Skift Research estimates that Airbnb generated $1.4 billion of gross bookings from China in 2019 and $143 million of revenue. This would represent 25% of Asia Pacific sales and 3% of global company revenue.”

Skift Research

“As a sense check to put this in context, out of Airbnb’s top ten revenue generating cities, Tokyo is the only one in the Asia Pacific region,” Skift Research said in December 2020. “We believe that Tokyo itself generates just shy of 1% of the global Airbnb revenue, likely around 90 basis points. With Beijing, Shanghai, and Shenzhen each pulling in even less per city, it’s hard to see how the China business could be more than 3% of global sales.”

Defeated by Local Rivals

Airbnb faced other rivals in China. One was Xiaozhu, which has raised more than a half-billion dollars in venture capital since 2012. This downmarket rival, backed by e-commerce giant Alibaba, helps Chinese travelers find short-term rental accommodation in China and other countries. Unlike Airbnb, it often provides property owners with services, such as housekeeping and door locks powered by facial recognition. It also offers add-on services like airport transfer and luggage delivery for guests.

Tencent-backed Meituan Dianping has also gotten into short-term rentals and homesharing.

In 2017 Airbnb co-founder Nathan Blecharczyk took charge of the company’s China business, including a rebranding of the company as Aibiying locally.

Airbnb will “refocus on providing listings for Chinese travelers going abroad,” and an official announcement may come this week, CNBC said.