Membership Collective Group is best known for its Soho House upscale member’s clubs and hotels and for being unprofitable for decades. The London-based company wants to change both of those things, it said during a Wednesday earnings call.

In a few weeks, it will change its name to Soho House & Co., and its executives said they have a path to profitability.

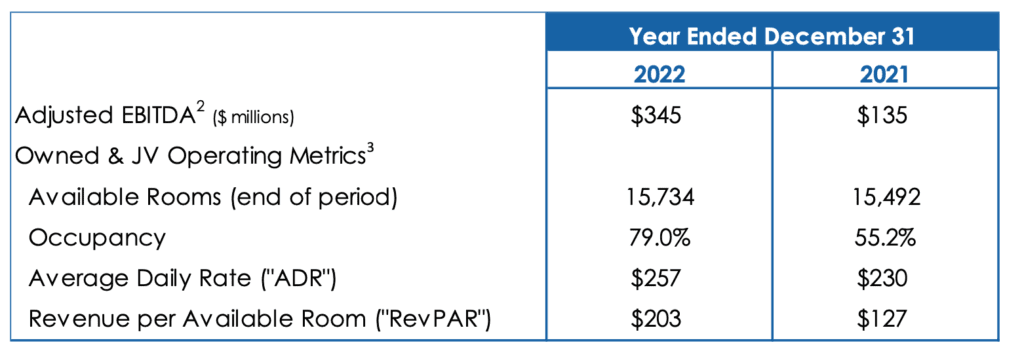

On Wednesday, Membership Collective Group reported that it had narrowed its losses in the fourth quarter, year-over-year. It had a loss of $13 million on revenue of $270 million.

“We’ve raised prices by a double-digit percentage this year,” Carnie said on Wednesday. “Since we’ve increased our new member pricing, we continue to see super high applications, which shows the strength of our business.”

Total members grew to 226,830, up 7 percent on the previous quarter.

The company forecasts that its 2023 revenue will come in between $1.1 billion and $1.2 billion. That partly reflects a moderation in the pace of its network expansion. The company is returning to a 5 to 7 openings a year pace — which is a pace that’s easier to streamline and keep profitable.

The company’s streamlining push has a few key areas, including analyzing data to find operational efficiencies.

Data analysis has, for instance, shown that its members are using their facilities just as much post-pandemic as before Covid, but they’re doing so at different times. So the company has adjusted how it schedules its staffing to reduce its in-house operating expenses.

“Wages as a percentage of revenues dropped approximately 1,000 basis points in December versus August last year,” Carnie said of this initiative’s impact.

The company has been trimming the production of content, digital, and other corporate expenses. In one example, it will cut its “editorial content” expenditure by about 40 percent “going forward.”

In recent months, the company said it has found “sizable opportunities” to be more cost-efficient in how it procures supplies for its food-and-beverage offerings.

“The changes we’ve made in our F&B program continue to drive growth margin expansion with like-for-like F&B margins 230 basis points above the final quarter of 2019,” Carnie said.

“It’s still early days in terms of driving the benefits of these profit initiatives, and we have much more to go,” Carnie said. “But we’re on track, and we feel confident that this will help us generate stronger, more [consistent] earnings going forward.”