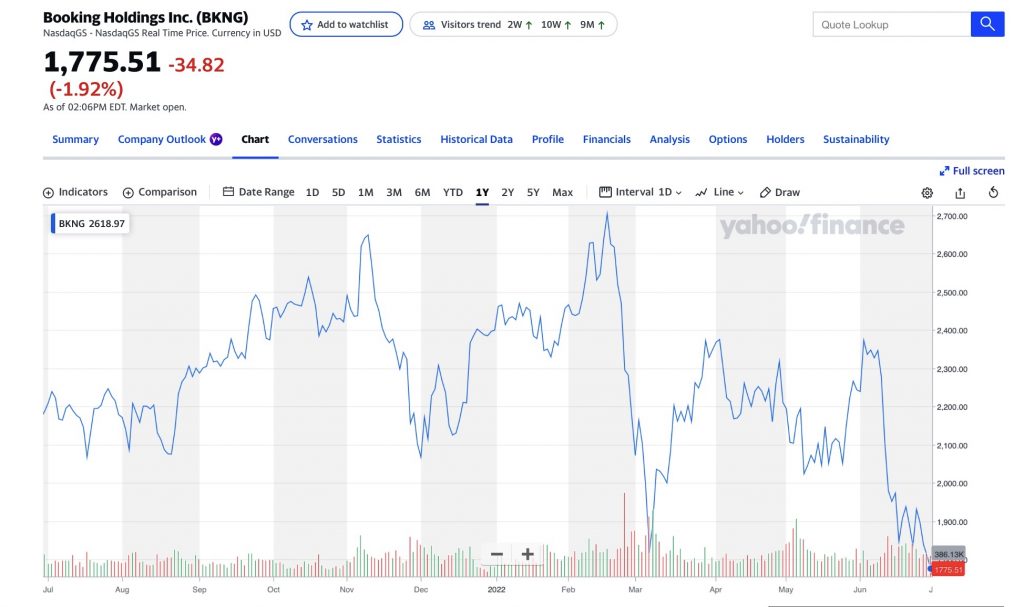

Booking Holdings is hiring rapidly at its new engineering office in Bengaluru, India, to work on new projects such as how to verify guest identification with machine learning and new products such as alternative forms of international payment to traditional credit and debit cards.

The parent company of Booking.com has about 20 employees at its tech center now but expects to ramp that up to about 100 by year-end, according to The Times of India. The business unit will work on how to use artificial intelligence and machine learning to better manage risks and hassles in travel transactions.

The company wants to verify IDs such as passports and driving licenses by linking the company to sources of identification data and using artificial intelligence and machine learning to scan these and verify identities automatically.

That is one of the projects that the Bengaluru office will tackle, Daniel Marovitz, senior vice president of fintech at Booking.com, told The Times of India.

The team will also look at possibly building a “foreign exchange card” as an alternative form of payment to a traditional credit or debit card. Today, many credit and debit cards charge a different, higher foreign exchange rate than the lowest available on the market.

The planned Booking.com product would attempt to offer a cheaper alternative. The ambition is for customers to use the card, which will come in physical and digital forms, for routine purchases and not just for booking a hotel. It may eventually enable customers to take advantage of buy-now-pay-later and other insurance-like products that Booking Holdings might operate on its own as a financial technology player.

Both projects fit with Booking Holdings CEO Glenn Fogel‘s vision for “a connected trip” that he laid out at Skift Global Forum in September (see video).

The news of the product testing and development dovetails with recent Skift Megatrends about the financialization of travel and how the rise of global mobile wallets are upending travel payments.